Generic drug prices rise for first time in seven months

The CLIFF NOTES

Inflation concerns are all the rage now. From labor to lumber, upward pressure on prices of all sorts of random things has replaced waning COVID-19 concerns as we gear up for the summer.

Of course, no one is talking about holistic drug pricing trends, simply because outside of what we do in this monthly report, there is no index measuring drug pricing inflation/deflation. Not to worry though; 46brooklyn’s got your back, filling one of the few remaining informational voids.

Interestingly, for the first time in seven months, Medicaid’s weighted average generic drug mix experienced inflation this month. Although we would caution you not to read too much into this. Unlike steel prices, generic drug prices aren’t experiencing some reopening-driven resurgence. They simply are following the same up and down path that they have been following since we started tracking fluctuation in the weighted average prices of generic drugs a few years ago.

Plus, the $30 million in annualized inflation this month pales in comparison to the $331 million in aggregate generic drug deflation over the past six months.

While that is the quick synopsis of what is going on with generic drugs, on the brand drug side, there were only 10 list price (i.e., Wholesale Acquisition Cost, or “WAC”) increases all throughout May – the lowest number of May price increases in at least a decade (second lowest was 25 in May 2018). So long story short, it’s way too early to lump prescription drugs into the basket of goods that are experiencing inflationary pressure as the U.S. awakes from its COVID-19-driven slumber.

For those of you interested in more details on the brand drugs, since we teased last month that price 2021 list price increases were set to eclipse all of 2020’s list price increases, the payoff has arrived. With 1,065 brand drug list price increases occurring prior to the halfway point of 2021, we have officially passed the total number of increases that occurred throughout the entirety of 2020 (i.e., a total of 1,064). But before you go grab your pitchforks and torches, we have some needed context from IQVIA, who released a big drug pricing data dump last month that showcased that while in 2020 brand drug list prices grew by 4.4%, net prices (after rebates and discounts) actually fell by 2.9%. While we do not track net prices ourselves at 46brooklyn, we have great conviction in the IQVIA data and its directional accuracy. So for those that use our list price tracker to tell stories about what’s happening in drug pricing, you are welcome to take your list price shot, but do not leave behind the necessary chaser of what’s happening underneath.

For more details on the specific brand drugs that moved in May, along with our standard recap on changes to surveyed generic drug acquisition costs, read on.

Brand Name Medications

1. 2021 brand drug list price increases eclipse all of 2020

There were a total of 10 brand name medications that saw wholesale acquisition cost (WAC) price increases in May, which are all featured and contextualized in our Brand Drug List Price Change Box Score. As mentioned above, the 10 increases put 2021 over the hump for more list price increases than in all of 2020, so buckle up because we still have more than half a year to go.

Price increases ranged from 2.3% to 10% and impacted $35 million in prior year gross Medicaid expenditures (or a drop in the bucket compared to the collective $69 billion Medicaid spent all of last year on prescription drugs). As a reminder, brand price increases in Medicaid are largely held in check thanks to the Medicaid Drug Rebate Program (MDRP), which includes rebate penalties for drug price increases.

2. Brand drug price changes worth taking note of in May

Because of the small number of price increases this month, we can quickly review each of them below:

May 1st price increases

Spritam (levetiracetam), a newer formulation of an existing generic drug to treat seizures, took a 7.3% price increase. Likely because it’s a re-formulation of a drug that already has generic versions, this medication had only ~$265,000 worth of gross spending in Medicaid spend last year.

Hizentra (immune globulin) is one of many immune globulin therapies for patients with primary immune deficiency or chronic inflammatory demyelinating polyneuropathy. This product saw a 5% price increase but is a very niche product with very little Medicaid utilization in CMS’ State Drug Utilization Data (SDUD).

Sylvant (siltuximab) is a monoclonal antibody used to treat multicentric Castleman disease. This product saw a 2.3% price increase but is also a very niche product with very little Medicaid utilization in CMS’ SDUD.

Ecoza (econazole) is a topical foam medication that is a reformulation of an existing generic cream. This product saw a 9% price increase but doesn’t have much utilization in Medicaid.

May 3rd price increase

Gammaked (immune globulin) is another one of many immune globulin therapies for patients with primary immune deficiency or chronic inflammatory demyelinating polyneuropathy. This product saw a 4.8% price increase (similar to the already discussed Hizentra); however, unlike Hizentra, this product had $19 million in gross Medicaid spend last year.

May 4th price increases

Forfivo XL (bupropion) is a reformulation of an existing generic antidepressant product. This product saw a 5% price increase that impacts approximately $900,000 in prior year gross Medicaid spend.

Tenormin (atenolol) is a product with heavy, direct generic competition (over 50 NDCs competing against the three branded NDCs). While it did see a 5% price increase, that increase impacts less than $100,000 in gross annual Medicaid spend based upon the prior year.

While all price increases have impacts on the system, price increases on brand drugs that have direct generic competition are relatively meaningless, and are likely reflective of manufacturers raising prices as a means to create more rebate inducements for pharmacy benefit managers (PBMs) or government programs to prioritize brand coverage over generics. While all that sounds somewhat harmless on the surface, it’s worth noting that drug middlemen are notorious for pocketing portions of these rebates and discounts, meaning many commercial employers or patients could get taken for a ride by these increases as a result of a backwards pharmacy benefits design.

May 5th price increases

Akten (lidocaine) is an eye drop used to prevent painful sensations as part of eye procedures. It saw the largest price increase by percentage in May at 10%; however, that increase impacts less than $100,000 in gross annual Medicaid spend based upon the prior year.

Atropine is an eye drop indicated for cycloplegia, mydriasis, and treating amblyopia. The product in our dashboard is marketed under a New Drug Application (NDA) and so appears in this month’s Box Score though its name suggest it’s competing in the market more as a generic than brand name medication. Regardless, this product saw a 9% increase in May.

May 21st price increase

Multaq (dronedarone) is a medication used to reduce the risk of going to the hospital for people with the irregular heart rhythm called atrial fibrillation. This product saw a 5% price increase, which impacts $13 million in gross annual Medicaid spend based upon the prior year.

3. So what’s happening with brand drug price increases?

All told this month, this was the fewest number of brand price increases in the month of May over the last decade and puts this year’s total number of price increases at 1,065 (compared to a total of 873 brand price increases this time last year). If we’re concerned about growing inflation, this month seemed tame for brand name drugs, though the growth in the number of products that have had a price increase year-to-date compared to last year is certainly worth keeping tabs on.

While a headline takeaway is certainly the break in a downward trend in the number of brand drug price increases (prior to this year, the number of annual list price increases has been declining steadily since 2016), it’s important to note that net prices after rebates and discounts have been declining.

Beyond that, while the number of list prices increases is up this year, both the median price increase and the weighted average price increase are at their lowest levels in a decade.

Generic Medications

4. Another unfavorable unweighted price change picture

Each month, we look at how many generic drugs went up and down in the latest month’s survey of retail pharmacy acquisition costs (based on National Average Drug Acquisition Cost, NADAC), and compare that to the prior month (Figure 1).

Basically, the quick way to read Figure 1 is to look for blue bars that are taller than orange bars to the left of the dotted line, and exactly the opposite to the right of the dotted line. That would indicate a good month – more generic drugs going down in price compared to the prior month, and less drug prices going up.

Figure 1

Source: Data.Medicaid.gov, 46brooklyn Research

That’s not what happened this month. Instead, for every drug that increased in price this month, only 0.83 decreased in price. That’s down from a ratio of 0.97 last month, and considerably below the 1.32 ratio just two months ago.

But as usual, take this unweighted price change analysis with a grain of salt. To really make heads or tails of all of these pricing changes, let’s weight these changes.

3. Weighted Medicaid generic inflation comes in at $30 million

The purpose of our NADAC Change Packed Bubble Chart (Figure 2) is to apply utilization (drug mix) to each month’s NADAC price changes to better assess the impact. We use Medicaid’s 2020 drug mix from CMS to arrive at an estimate of the total dollar impact of the latest NADAC pricing update. This helps quantify what should be the real affect of those price changes from a payer’s perspective (in our case Medicaid; individual results may vary).

The green bubbles on the right of the Bubble Chart viz (screenshot below in Figure 2) are the generic drugs that experienced a price decline (i.e. got cheaper) in the latest survey, while the yellow/orange/red bubbles on the left are those drugs that experienced a price increase. The size of each bubble represents the dollar impact of the drug on state Medicaid programs, based on utilization of the drugs in the most recent trailing 12-month period (i.e. bigger bubbles represent more spending). Stated differently, we simply multiply the latest survey price changes by aggregate drug utilization in Medicaid over the past full year, add up all the bubbles, and get the total inflation/deflation impact of the survey changes.

Figure 2

Source: Data.Medicaid.gov, 46brooklyn Research

Overall, in May, there was $126 million worth of inflationary drugs, offset by $96 million of deflationary generic drugs, netting out to $30 million of inflation for Medicaid.

Before we dive into some of the specific drug details, we have one more top-down analysis to run – that is to investigate how generic drug prices are trending over time.

4. Year-over-year generic oral solid deflation remains stable

Ever since last June, we have been tracking year-over-year generic deflation for all generic drugs that have a NADAC price. We once again weight all price changes using Medicaid’s drug utilization data. Beginning in August 2019, we had been seeing a gradual compression in deflation (Figure 3). But oddly enough, looking back, the start of the pandemic turns out to have been the low point for generic deflation, with the deflationary trend rapidly moving upward ever since. This month, deflation on both oral solid generics and all generics remained stable, at 17% and 12%, respectively.

Figure 3

Source: Data.Medicaid.gov, 46brooklyn Research

5. Top/notable generic drug decreases this month

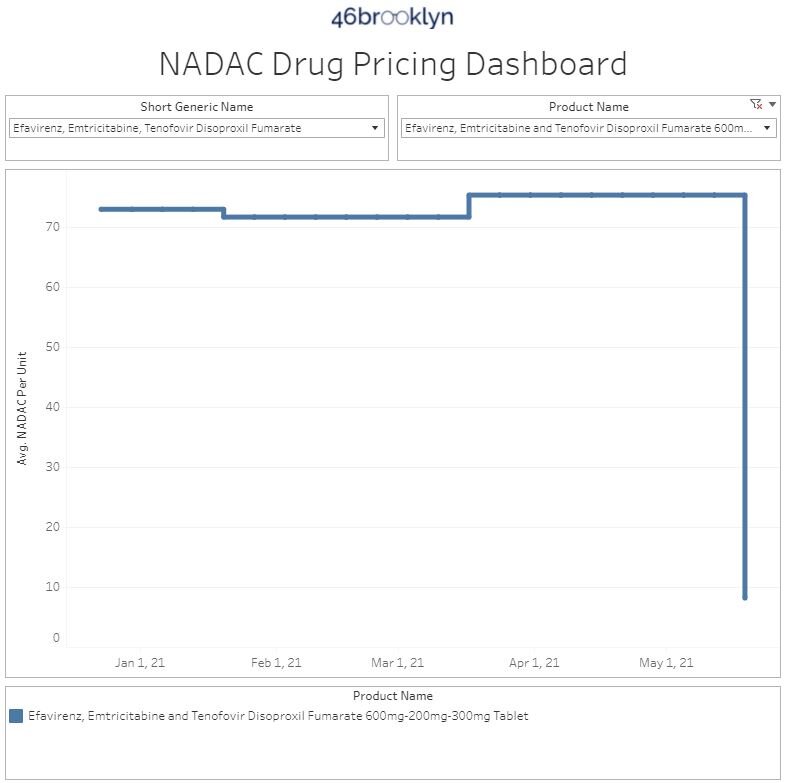

While the overall Medicaid mix identifies generic drug inflation this month, there are several generic drug price decreases worth noting. The most interesting, at least in our opinion, are the generic HIV therapies for Truvada (emtricitabine-tenofovir disoproxil) and Atripla (efavirenz-emtricitabine-tenofovir disoproxil). While we recently investigated the pricing dynamic of generic Truvada, we did not discuss generic Atripla whose current NADAC price is only $8.17 per tablet (a decrease of $67.20 per tablet from this time last month, a 89% decrease [Figure 4]).

Figure 4

Source: Data.Medicaid.gov, 46brooklyn Research

We suspect that more generic deflation is in store for these products in the coming month(s). This is because NADAC currently lags behind the current market by a couple month’s due to its methodology. We continue to hope that efforts will be made to reduce this pricing lag given NADAC’s important role in pricing claims for Medicaid and other payers.

6. Top/notable generic drug increases

The most notable price increases were methylphenidate ER 36 mg (a medication to treat ADHD), paliperidone ER 3-, 6- & 9 mg (a medication used to treat schizophrenia), and naproxen 550 mg (a medication to relieve pain and inflammation). The NADAC price trends for these products can be reviewed in the subsequent chart:

Generic price increases and decreases can be irregular when it comes to NADAC and can shift pretty quickly from month to month; that is part of why we developed ADPIT, to look more closely at outliers.

7. ADPIT (once again) gives us the “all clear” on extreme upward generic drug pricing movements

Finally, let’s check in on our Abnormal Drug Pricing Increase Tracker (ADPIT) and see what it has to say about this month’s data. As a reminder, ADPIT takes all of the NADAC prices for one drug over any given 52-week period, ranks them, finds the 90th percentile for the price, and then compares the current price to that 90th percentile price. If the current price is above the 90th percentile, we consider the current week’s price to be “abnormal” and add it to the list for you to peruse. Then we do this for another 20,000 or so drugs for good measure to complete the list, shown in Figure 5.

As we examined ADPIT this month, we continued to be impressed by the extremely low overall Relative Impact Score (bottom right chart in Figure 5), which as a reminder is a unitless measure we created simply to size all of the abnormal upward pricing movements in generic drugs. This metric continues to hover at the lowest levels we’ve seen in the last three years, a very encouraging sign that there are very few ultra-inflationary retail generic drugs lurking in the shadows of the murky U.S. drug supply chain. ADPIT also offers some additional evidence that, unlike steel and lumber, the modest inflation we saw this month was not abnormal.

Figure 5

Source: Data.Medicaid.gov, ClinicalTrials.gov, 46brooklyn Research

Thanks to Bob Herman at Axios, Maia Anderson at Becker’s Hospital Review, and Marty Schladen at the Ohio Capital Journal for covering our recent report on Truvada’s generic launch and giving some needed spotlight for a few pharmacies that are working to work around a backwards system.

Kudos and congratulations to Ohio Attorney General Dave Yost for getting his first big recoupment from alleged PBM overcharges on prescription drugs in Ohio and state Medicaid programs across the country. The total settlement looks like it could approach more than $1 billion, and there is likely more to come. Many of you know our story began in Ohio, working with state officials and tireless reporters at the Columbus Dispatch to expose the hidden markups – the same markups that Yost is working to retrieve for taxpayers. Cheers to a good old fashioned serving of justice.