What’s happening to generic drug prices? July 2019 NADAC Survey Update

Hey there, drug pricing aficionados. Good news. CMS released their NADAC survey results last week, which means it’s time to check in on this month’s generic drug price changes.

There was a lot of movement on drug prices this month, so be sure to click through our new updated visualizations (NADAC Change Packed Bubble Chart and Drug Pricing Dashboard) to see the impact.

As a reminder, each month, retail pharmacies across the country are surveyed by Myers Stauffer (on behalf of the Centers for Medicare and Medicaid Services) on their wholesaler invoice prices. The results are then compiled and released either the third or fourth week of the following month. On July 17th, survey results were released that reflect National Average Drug Acquisition Cost (NADAC) price changes from June. Here are our top takeaways on the results:

1. July unweighted price change histogram is nearly identical to June

Each month, we first look at how many generic drugs went up and down in the latest month’s survey of retail pharmacy acquisition costs, and compare that to the prior month. As shown in Figure 1, when just looking at the count of generic drugs that experienced price increases and decreases, July looked a whole lot like June, which wasn’t exactly worth celebrating. Again, more generic drugs increased in price than those that decreased in price.

Figure 1

Source: Data.Medicaid.gov, 46brooklyn Research

For every generic drug that experienced a price decline this month, there were 1.07 generic drugs that experienced a price increase. Last month that ratio was 1.15.

When compared to June, in July there were 4% more generic drugs that experienced a 0-10% price increase, but 15% fewer generic drugs that experienced a price increase of more than 10%. There were also 3% more drugs that experienced a 0-10% price decrease, and 22% more drugs that experienced a price decrease of more than 10%.

Overall, not much movement when you look at this on an unweighted basis.

2. This month brought $76 million of annualized deflation using Medicaid’s drug mix

But July shows us why it’s so important to weight price changes, as we do in our NADAC Change Packed Bubble Chart.

After weighting the generic price changes this month, we calculate $76 million in annualized deflation. Recall, last month we calculated $49 million in annualized inflation. This is a great improvement after two months of relatively lackluster generic performance.

So, how can we see so much weighted deflation when more drugs increased in price versus decreased in price?

Only one way of course… there has to be major deflation this month on some of the heavyweight generic drugs in Medicaid. This is exactly what pops out of the bubble chart. The #1 generic in Medicaid (Methylphenidate ER 36mg Tab) dropped a whopping 21%. This one drug was responsible for $42 million of annualized deflation, which amounted to 56% of overall deflation this month.

It turns out this month was completely about quality over quantity. In 2018, state Medicaid programs spent $744 million on the top 6 oral solid generic drugs. Here are the top six:

$203 million: Methylphenidate ER 36 MG Tab (generic Concerta)

$149 million: Buprenorphine-Naloxone 8-2 MG SL Tablet (generic Suboxone)

$130 million: Methylphenidate ER 54 MG Tab (generic Concerta)

$100 million: Methylphenidate ER 27 MG Tab (generic Concerta)

$82 million: Methylphenidate ER 18 MG Tab (generic Concerta)

$80 million: Oseltamivir Phos 75 MG Capsule (generic Tamiflu)

Let it settle in for a moment that four of the top six generic oral solids in Medicaid are different strengths of the same ADHD drug (states may want to take more serious looks at patient accessibility to behavioral health specialists) … and #2 is an opioid treatment drug.

We can learn a lot about our country from the drugs it takes.

Anyway, as you will see below, five of the six of these top 6 generic drugs experienced double-digit price declines in July, bringing the weighted average decline for these six to 12.9% in just one month! That’s a lot of deflation exactly where state Medicaid programs need it the most. Note: this viz scales weirdly on some devices. For the best experience, click here.

As a reminder, we use Medicaid’s 2018 drug mix to arrive at an estimate of the total annualized dollar impact of the latest NADAC pricing update. The green bubbles on the right of the dashboard below are the generic drugs that experienced a price decline in the latest survey, while the yellow/orange/red bubbles on the left are those drugs that experienced a price increase. The size of each bubble represents the annualized weighted impact of the drug on Medicaid – i.e. we multiply the survey price change by aggregate drug utilization in Medicaid.

3. Year-over-year deflation increases to 13%

Last month, we spent gobs of time going back and calculating year-over-year (YoY) deflation for the last 24 months in order to get a better idea of how the market is performing over an extended period of time. We then gasped as we saw June deflation rates drop below 10% for the first time over the last two years.

But we can now breathe a slight sigh of relief (at least for the next few weeks). Thanks in large part to sizeable deflation on the heavyweight generics discussed in the prior section, July year-over-year generic deflation popped back up to 13%.

Figure 2

Source: Data.Medicaid.gov, 46brooklyn Research

If you’re curious about how we created this chart, take a look at our June 2019 NADAC survey report for more detail on our methodology.

4. Schizophrenic generic Concerta pricing

Don’t get too comfortable though. If there is one drug with pricing that we don’t trust, it’s generic Concerta (Methylphenidate ER), which was heavily scrutinized by members of the U.S. Senate back in 2017 for some pretty eyebrow-raising cost increases shortly after some drugmakers encountered equivalence issues with the FDA. Today though, for an extremely highly-utilized drug, and nearly 10 different labelers, this should be a pretty cheap drug. But it isn’t. In fact, after massive price spikes in 2017, the price has been bouncing all over the place, and it still hasn’t recovered from the big increase from two years ago (Figure 2).

Figure 2

Source: Data.Medicaid.gov, FDA.gov, 46brooklyn Research

As you can see from the charts, the prices are all over the map. This month, here was the percentage movement of each tablet strength:

METHYLPHENIDATE ER 10 MG TAB 46.72%

METHYLPHENIDATE ER 18 MG TAB 2.21%

METHYLPHENIDATE ER 20 MG TAB 7.52%

METHYLPHENIDATE ER 27 MG TAB -10.80%

METHYLPHENIDATE ER 36 MG TAB -20.88%

METHYLPHENIDATE ER 54 MG TAB -5.51%

As demonstrated above in Section 2, with so much Medicaid spending wrapped up in Methylphenidate, even the slightest budge in price can have a huge impact on state programs.

With the price per tablet of Methylphenidate ER (18 mg, 27 mg, 36 mg, and 54 mg strengths) hovering around a whopping $5 per tablet, here is a bit of perspective. This week, we highlighted the much-anticipated release of generic Lyrica (Pregabalin). This was also a highly-utilized drug with 10 labelers that came to market at a discount of more than 97% to the brand version (pre-rebate). We heard from pharmacies that upon its release this week, Pregabalin’s invoice cost to pharmacies was around $0.20 per pill. This represents massive savings.

However, go back to Methylphenidate ER Tablets – which have been on the market for years. At a minimum, it should have seen significant deflation since the 2017 spike, but after two years, the price is 25 times as high as Pregabalin’s one-week-old price. Now, this is not a perfect apples-to-apples comparison, but you get the idea: similar market dynamics, but completely different market results.

5. After a long, controversial road, generic Albenza prices are finally beginning to fall

The anti-parasite drug Albendazole (brand-name Albenza) has been around for decades. Yet despite its patent expiration, for years, no generic drugmakers brought a competitor to market. According to a highly-informative research piece in the New England Journal of Medicine from Jonathan Alpern, William Stauffer, and Aaron Kesselheim, the Average Wholesale Price (AWP) – which is essentially the sticker price for a drug – was only $5.92 per pill. By 2013, that price had jumped to $119.58 per pill.

What happened?

In October 2010, Albenza manufacturer GlaxoSmithKline sold the drug’s rights to CorePharma/Amedra Pharmaceuticals in bulk sale that also included Dexedrine and a little drug you may have heard of called Daraprim. At the time of the sale, CorePharma CEO Christopher Worrell was quite pleased with the arrangement. “The acquisition of these products will play an important strategic role in our growth,” he said.

According to Jonathan Alpern and his research team, “In 2011, Teva Pharmaceuticals discontinued manufacturing of the only therapeutically interchangeable antiparasitic agent, mebendazole (Vermox), for non–safety-related business reasons, and prescribing of mebendazole slowed,” which left Albenza with a near essential monopoly within the drug class.

This was exacerbated further in 2013 when Amedra purchased mebendazole from Teva, clearing the prescription market of any meaningful competition. It was the perfect opportunity for raising prices. As University of Maryland’s Joey Mattingly pointed out after the acquisition,, “Amedra Pharmaceuticals legally acquired a monopoly-ish control of the treatment of parasitic infections and that nothing in this case seems all that ‘shady’ or evil. It is just business strategy and US laws allow it.”

In 2014, Impax Laboratories acquired Tower Holdings, including its operating subsidiaries CorePharma, Amedra Pharmaceuticals, and Lineage Therapeutics. According to the press release at the time, Impax was set to achieve wonderful transactional benefits: The ”highly-profitable portfolio consists of four branded products, including the branded Albenza® franchise,” which “is the leading treatment for invasive tapeworm infections. This niche product has attractive margins and a record of strong sales growth with well-developed lifecycle management strategies to support continued returns.”

Along with the purchase, Impax Labs had acquired the rights to Daraprim as well, which they sold months later to Turing Pharmaceuticals. We all know what happened after that.

But back to Albenza … by late 2015, the AWP had shot up to $201.27 per pill, and the NADAC hung around $150 per pill. The controversy over the price continued to roll into 2017, especially since the same drug could be acquired in Tanzania for $0.02 per pill.

In May 2018, Impax/Lineage combined with Amneal Pharmaceuticals. In September 2018, Albenza lost exclusivity, opening the doors to generic competition.

Late that month, the generics started coming to market … err … it would actually be more correct to say the generic, because one of the two was an ‘authorized generic’ produced by the same Impax/Lineage/Amneal company off the same Albenza brand drug application. The other generic version came from Cipla Limited. Cipla set its AWP at a whopping $228.91 per unit, quite a deal at the time given that Albenza carried an AWP of $265 per unit.

The loss of exclusivity officially started impacting Amneal’s sales numbers. Regardless, even as recent as this month, the high prices of Albendazole continue to be in the news, but at long last, we’re finally able to say that meaningful competition has officially hit the market, with now six different labelers driving the previous brand price of $232.17 per pill down to a generic NADAC of $123.90 per pill.

Figure 3

Source: Data.Medicaid.gov, FDA.gov, 46brooklyn Research

In this month’s NADAC survey update, the price of Albendazole has dropped by nearly 16%, which amounted to a price erosion of $11.42 per pill.

While this is a relatively low-utilization drug, outside of Medicaid, many patients have struggled mightily with affordability of the Albendazole, and these new savings are a result of much-needed generic competition finally hitting the market.

Sadly though, years of staggering price increases on the brand have set such a high starting price for the generic that it will now likely take considerable time for generic prices to work their way down. We’ve seen this time and again with some of the more obscure drugs in this country – aggressive brand pricing increases (which may not even be “real” because of the secretive and unknown rebates funneling back to the PBM on brand drugs) push the generic launch AWP into the stratosphere. Payers then move to the generic, are subjected to these artificially inflated prices, and lose their rebates. It could be years before payers are actually saving money on a generic in such a situation. This is another reason why rebate reform is important.

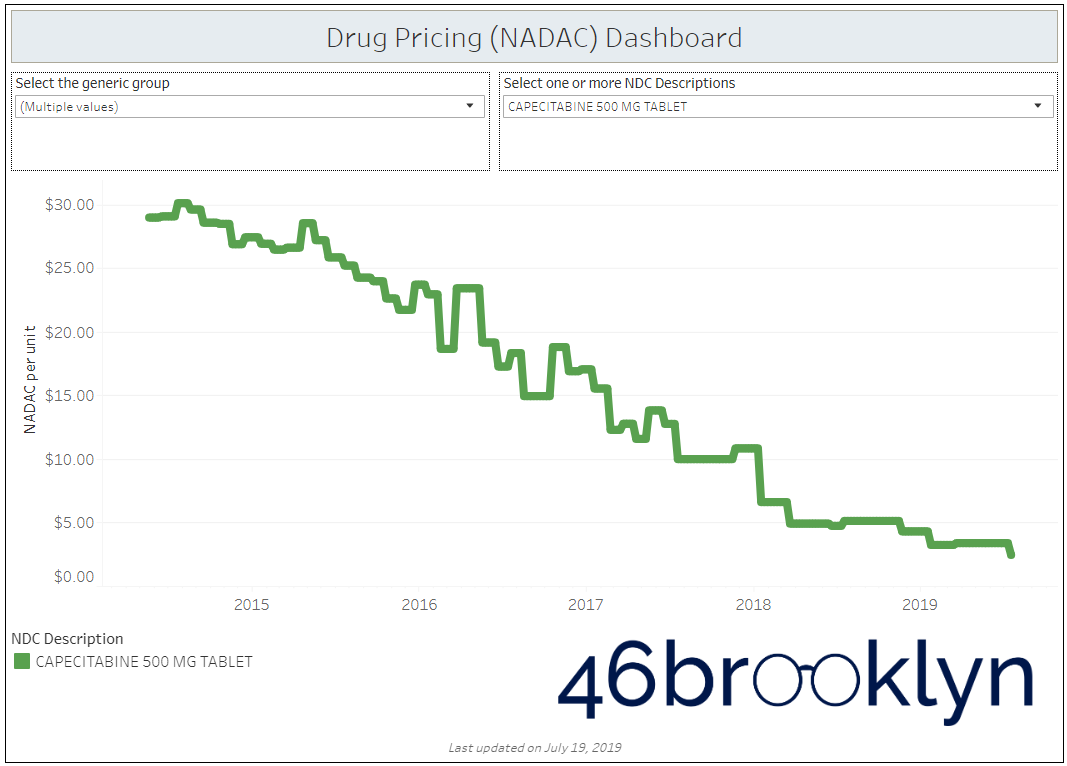

7. Generic oral chemo agent (Gleevec, Xeloda) prices keep falling

Over the past year, we’ve beaten generic Gleevec (Imatinib Mesylate) pricing to death in our writing. It turns out generic competition has done the same thing – its NADAC was down another 22% this month to $12.79 per pill.

Looking at the other top generic oral chemotherapy agents this month, Imatinib was not alone in its journey down the pricing mountain – generic Xeloda (Capecitabine) cratered another 27% to just $2.45 per unit. There are now nine different applications for this drug distributed by 13 different labelers. With this level of competition, this once expensive “speciality drug” appears to be on its way to the dollar store.

But don’t get too excited yet! Just because the drug is getting cheaper, it doesn’t mean payers are guaranteed to save money. As we have highlighted in our previous work and as Bloomberg has showcased in their data analyses, deflating prices provide an opportunity for margin-capture by members of the prescription drug supply chain.

Below, you can see what has happened in the Texas Medicaid managed care program. As the NADAC prices of Imatinib Mesylate and Capecitabine have plummeted, PBMs via their Medicaid managed care plans have continued to increase the markup.

Where is all the markup going? While it’s hard to know for sure, we took a stab at it in our Ohio report from back in April. Fortunately, the picture has become even clearer since then. Last month, the relentless team at the Columbus Dispatch continued their accountability assault on the drug supply chain by inspecting what happened to pharmacy margins after the state prohibited PBM “spread pricing” in Medicaid managed care.

The Dispatch analysis showed that pharmacy margins skyrocketed on these specific drugs after PBMs were required to stop skimming spreads off the top of drug claims. The pharmacy markups were already hefty in 2018, but in 2019, after the state killed PBM spread, the pharmacy margins on Imatinib Mesylate increased by nearly 600%, and the margins on Capecitabine increased by nearly 1,200% (Figure 4).

What was odd to us about these numbers was the fact that pharmacies have no control over the reimbursements from larger PBMs (especially the independent and small chain pharmacies that were analyzed by the Dispatch). An increase in margins to this degree would be set by the PBM and have little to do with the pharmacy. Essentially, the PBM decided to begin paying a lot more for these drugs. Why? That’s hard to know for sure, but we think the Dispatch is pretty close to the mark: "Ohio’s largest Medicaid pharmacy benefit manager, CVS Caremark, increased its rates for specialty drugs at the beginning of this year, even though the cost of many of them was dropping nationally. Along with raising the price for Ohio taxpayers, CVS benefits from the inflated cost because its PBM directs many of these prescriptions to CVS specialty-drug pharmacies.”

The big takeaway here is that sometimes, the marketplace works to drive down prices of generic drugs, but because of the complexities, opacity, and warped incentives embedded within the drug supply chain, those who foot the bill for drugs like these don’t always get the benefits of when the system is actually working. If you think that eliminating spread pricing is all that needs to be done to fix this system, you have much more Jedi training to complete, young padawan.

What are you seeing?

While we spend more time than we’d like to admit studying the pricing changes during each NADAC Survey Results Week, we don’t always catch every story worth noting. Be sure to take a gander at all of our updated Visualizations that rely on NADAC prices. If you’re seeing any interesting movement on drugs in the dataset, let us know.

This week, the U.S. Senate Finance Committee gave us reason to cheer. As you know, we are big fans of National Average Drug Acquisition Cost (NADAC), an excellent pricing benchmark that we can use to better show what drug prices are doing in the marketplace. However, even though it’s the best, free publicly-available benchmark out there, it still has room for improvement. For example, the lack of wholesaler rebate information, the lack of brand manufacturer rebate information, missing drugs, etc. Despite these shortcomings, it’s still solid, but there is room for improvement.

Well, buried in the big drug pricing reform package sponsored by Senators Chuck Grassley and Ron Wyden, are new provisions to beef up the NADAC survey that will make it incredibly more useful and thorough.

You can view the full proposal that was marked up yesterday here, check out these specific details on beefing up the survey data:

“The provision would also amend Section 1927(f) to require the HHS Secretary to conduct a survey of retail community drug prices to include the national average drug acquisition cost. The HHS Secretary would be able to employ a vendor to contract for services with respect to the survey. Retail community pharmacies that receive payment related to the dispensing of CODs to individuals receiving benefits under Medicaid would be required to respond to the survey. Information on retail community prices obtained through the survey would be made publicly available and include at least the following: the monthly response rate and the list of pharmacies out of compliance with reporting requirements; the sampling frame and number of pharmacies sampled monthly; characteristics of reporting pharmacies; reporting of a separate national average drug acquisition cost for each drug for independent retail pharmacies and chain operated pharmacies; information on price concessions including on and off invoice discounts, rebates, and other price concessions; and information on average professional dispensing fees. A pharmacy that fails to respond to the survey or knowingly provides false information in response to the survey could be subject to penalties in addition to other penalties that may be imposed under law.

The HHS Secretary would also be instructed to issue a report to Congress examining specialty drug coverage and reimbursement under Medicaid including a description of how State Medicaid programs define specialty drugs, how much State Medicaid programs pay for specialty drugs, how States and managed care plans determine payment for specialty drugs, the settings in which specialty drugs are dispensed, whether acquisition costs for specialty drugs are captured in the national average drug acquisition cost survey, and recommendations as to whether specialty pharmacies should be included in the survey of retail prices. The provision would appropriate $5 million for fiscal year 2020 and thereafter to carry out the survey and related activities. These changes would take effect 18 months after the date of enactment of this law. The provision would also require manufacturers to report wholesale acquisition cost for covered outpatient drugs and for the Secretary to make such information available on a public website.

We realize these changes are small relative to the other big provisions of the bill, so we intend to follow this piece closely and will keep you informed of its progress. We are big fans of bigger and better and free-er data, so these proposed NADAC upgrades would be awesome. Stay tuned.