Recently, CMS updated their State Utilization databases, which provides quarterly drug pricing data that shows what state Medicaid programs are spending on prescription drugs. This most recent data update ended up filling in most of the Q2 2018 potholes and extended the 2018 data to include large portions of the third quarter. We have updated all of our dashboards that rely on this dataset, rolling all of them forward to Q3 2018, and there are some insightful takeaways. This update is a really big deal for us at 46brooklyn, because it is the first time that a dataset’s timing will overlap with our existence as an organization. With our launch in August 2018, this meant that CMS’ latest utilization data update for Q3 2018 would be the first real quarter of data that could have been theoretically impacted by our work and Ohio’s work to bring transparency to drug pricing in state Medicaid programs and beyond. After analyzing the data, the results are nothing short of amazing, and a clear indication that this system is in the midst of change. Here’s our insights.

Read MoreOver the last nine months we have sliced and diced generic drug pricing within Medicaid managed care to arrive at the conclusion that generic prices in Medicaid are subject to wild and seemingly arbitrary distortions. But the million dollar (or should we say $2 billion dollar) question is whether this problem is isolated to Medicaid, or if it is a broader issue plaguing Medicare Part D and Commercial plans as well? We now attempt to bring data into the fold to help answer this question. In this report, we embark on an in depth investigation into the pricing of the top 15 generic drugs in Medicare Part D - drugs that represented roughly a third of overall Part D generic spending in 2017. It turns out that the same arbitrary generic pricing behavior we have observed in Medicaid is alive and well within Part D. If you make it all the way to this report, you will be rewarded with all the math that estimates this problem to be worth over $2 billion in 2017.

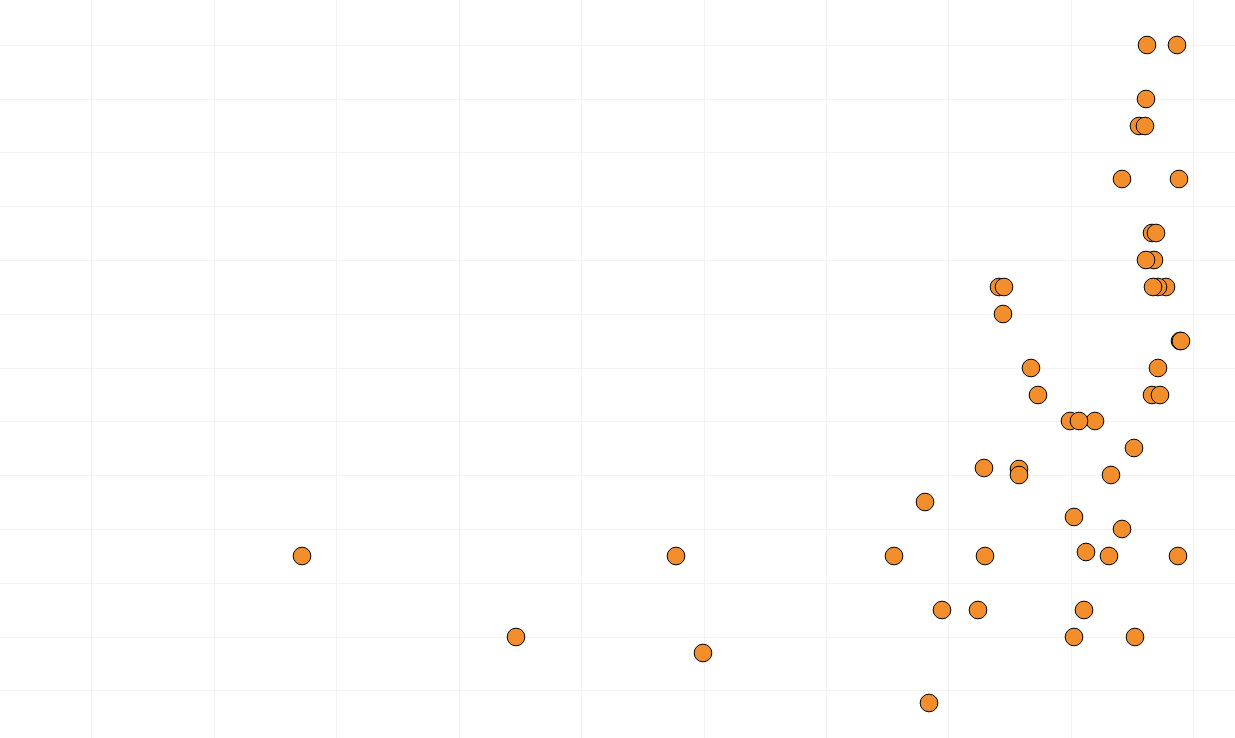

Read MoreA few months ago, we released our Medicaid Markup Universe that collects all generic drugs dispensed within different state Medicaid programs and displays each as a bubble. The larger the bubble, the greater the cost the state is paying for that drug relative to its acquisition cost (i.e. “markup”). While that dashboard provides a good qualitative feel for individual drug pricing distortions, it doesn’t help quantify the distortions. To better identify those distortions in each Medicaid program, we designed a new visualization that drills down to three different groups (or celestially-speaking, “galaxies”) within the universe. We call them the High-Cost, In-Range, and Low-Cost galaxies. Our newest dashboard, the Medicaid Markup Galaxies, shows which drugs state Medicaid programs may be underpaying for, and perhaps more importantly, which drugs they may be overpaying for.

Read MoreThe start of each new year brings a lot of “new-ness,” including a new round of price increases on brand-name drugs. This year has been no exception, and the media has been all over the subject. Unfortunately, we’ve found it difficult to figure out the “so what?” behind all of these price increases. On one hand, we are being told that the pharmaceutical manufacturers are back to “business as usual,” while on the other we are being told that the number of price increases are down meaningfully from last year. Which one is it? This felt like an opportunity to inject a healthy dose of facts into this discussion. So we set out to build a dashboard, 46brooklyn’s Brand Drug Price Change Box Score, that lets you visualize all brand-name manufacturer list price changes that are publicly-reported each week, drill down to the manufacturer and drug level, strength level, and compare and contrast different periods.

Read MoreAverage Wholesale Price (AWP) is a meaningless benchmark price for generic drugs. This has been known for at least a decade, if not longer. But despite its lack of substance, AWP-based payment models just won't go away. Unfortunately the contractual reliance on a benchmark that has no relevance to actual price makes it very difficult for the payer to know if they are getting a good deal or not. They are left to pay a fixed discount off of an unknown combination of meaningless, non-market-based, numbers. Seems like that would be tough sell, but this is drug pricing we are talking about, so of course, it's the norm. For the past couple months, we compiled data to create a visualization to help illustrate the problem that arises by anchoring generic drug costs to AWP. The finished product is embedded in this latest report "Inside AWP: The Arbitrary Pricing Benchmark Used to Pay for Prescription Drugs," along with our observations and analysis.

Read MoreWe’re told that drug prices are too high, but who actually is setting the price and where does the money end up going? CMS recently updated their State Utilization databases, which track what state Medicaid programs are being charged for prescription drugs. Most notably, they extended the 2018 data to include the second quarter. We have updated our datasets and visualizations to track the changes in drug markups relative to their actual costs. We’ve studied up and have come up with our “Top 20 over $20” list. In other words, the top 20 drugs dispensed through Medicaid managed care organizations (MCOs) with a markup in of over $20 per prescription. Think of it as a “top 40 under 40” list for generic drugs, with the main difference being that no self-respecting generic drug wants to be on this list. Check out our new visualization that highlights the drugs that are busting the budgets of state Medicaid programs.

Read MoreOver the past couple weeks, we’ve been reflecting more on how neat Bloomberg’s Ohio Medicaid markup bubble chart was in their recent article, “The Secret Drug Pricing System Middlemen use to Rake in Millions.” We’re kicking ourselves now that we neglected to delve deeper into this in our report, “Bloomberg Puts Drug Pricing ‘Markups’ on the Map”. But like fine wine, good visualizations only get better with time, so it took us a few weeks to fully realize the possibilities that such data analysis could open up. Bloomberg’s excellent visualization does, however, leave a few open questions. What do other state Medicaid managed care programs look like? How do they compare to state fee-for-service programs? What do all states look like? To answer these questions, we set out to build a new visualization dashboard to compare drug markups between state Medicaid programs. We call our creation the “Medicaid Markup Universe” (because it looks very celestial). In this new visualization tool, we found a disturbingly large difference in drug markups across generic drugs in state Medicaid managed care programs, resulting in a slew of warped incentives that pressure supply chain members to value certain medications over others, and thus, certain patients over others.

Read MoreEarlier this week, Bloomberg reporters published their results of a fascinating deep dive into Medicaid generic drug prices. The piece did an excellent job explaining the ins and outs of the hidden pricing spreads that exist on generic drugs, and it featured some intuitive visualizations that helped educate readers who may not have been familiar with these little-known drug price tactics. The analysis conducted by Bloomberg also integrated the results of a recent report from the state of Ohio's Auditor, which found that in a one-year span, PBMs pocketed more than $224 million dollars in spread pricing. Armed with this data, we set out to discover if we could deduce what pharmacy margins were over that same time period in an effort to peel back new layers of the onion and provide better information on where the money is going. Check out our newest drug pricing report to learn more about hidden prescription drug markups.

Read MoreIn August, the U.S. Department of Health & Human Services (HHS) released a special report highlighting the Trump administration’s progress on lowering drug prices for Americans. The HHS report, which focused on the first 100 days since the administration released its American Patients First blueprint, claimed to have achieved less brand-name drug price increases and more drug price decreases than the same period in 2017. While this is great to hear, we wanted to learn more about what this means for consumers. This 46brooklyn report highlights where the Trump administration seems to be making headway, where things still seem incomplete, and why despite any progress made on list prices, it may not mean that spending on prescription drugs has declined.

Read More